In the world of stock market analysis, tools that offer both precision and usability are invaluable. One such tool that has gained significant attention is the logarithmic stock chart free tool. With its ability to represent data in a way that highlights percentage changes rather than absolute values, it becomes an essential instrument for traders and investors alike. This tool is particularly beneficial for those who wish to gain insights into long-term trends and make informed investment decisions without incurring extra costs.

The appeal of the logarithmic stock chart free tool lies in its simplicity and accessibility. Unlike linear charts, which can sometimes distort data, especially over extended periods, logarithmic charts provide a more balanced view. This makes them ideal for comparing the performance of stocks over time, allowing users to visualize the rate of growth in a more intuitive manner. The best part? It’s free, making it accessible to beginners and seasoned investors who are looking to enhance their analytical toolkit without financial commitments.

In this comprehensive guide, we will delve into the intricacies of the logarithmic stock chart free tool. We will explore its benefits, how to effectively utilize it, and why it stands out in the crowded field of stock analysis tools. Additionally, we will provide practical tips on interpreting charts and integrating them into your investment strategy. Whether you are new to the stock market or an experienced trader, understanding the nuances of this tool can provide a significant edge in your trading endeavors.

Table of Contents

- Introduction to Logarithmic Stock Charts

- How Logarithmic Charts Differ from Linear Charts

- Advantages of Using Logarithmic Stock Charts

- Understanding the Logarithmic Scale

- Implementing Logarithmic Stock Chart Free Tool

- Practical Application in Stock Analysis

- Common Misconceptions About Logarithmic Charts

- Case Studies and Real-World Examples

- Integrating Logarithmic Charts into Investment Strategy

- Tools and Platforms Offering Free Logarithmic Charts

- Step-by-Step Guide to Using Logarithmic Stock Chart Free Tool

- Comparing Popular Logarithmic Chart Tools

- Future Trends in Stock Chart Technology

- Frequently Asked Questions

- Conclusion

Introduction to Logarithmic Stock Charts

Logarithmic stock charts are a powerful tool for investors looking to analyze stock performance over time. Unlike traditional linear charts, which display price changes in absolute terms, logarithmic charts focus on percentage changes. This feature makes them particularly useful for observing long-term trends, as they offer a more balanced view of growth.

Understanding logarithmic stock charts begins with recognizing their unique scaling system. On a logarithmic scale, equal vertical distances represent equal percentage changes. For example, a move from $10 to $20 appears the same as a move from $100 to $200, both representing a 100% increase. This scaling method allows for more meaningful comparisons over time, making it easier to identify consistent growth patterns. The logarithmic stock chart free tool provides users with access to this analytical capability without any associated costs.

The development of logarithmic stock charts can be traced back to the need for a more accurate representation of stock performance over time. Traditional linear charts can often distort the true nature of stock movement, especially when dealing with large datasets or extended time periods. Logarithmic charts address this issue by emphasizing relative changes, offering a clearer picture of a stock's trajectory.

How Logarithmic Charts Differ from Linear Charts

Logarithmic charts and linear charts serve different purposes and offer distinct perspectives on data representation. The primary difference lies in how they scale data along the vertical axis. Linear charts display absolute price changes, where equal distances represent equal dollar changes. This can be misleading for stocks with large price ranges, as it may exaggerate movements that are not significant in percentage terms.

In contrast, logarithmic charts use a scale where equal distances represent equal percentage changes. This scaling method is particularly beneficial for visualizing exponential growth or compound interest effects. It allows for a more accurate representation of stock performance over time, especially for long-term investors. For instance, a stock that grows from $10 to $100 over a decade will show a consistent upward trend on a logarithmic chart, reflecting its 900% growth, whereas a linear chart might make such growth appear less dramatic.

Choosing between logarithmic and linear charts depends on the specific analysis goals. For short-term trading or when analyzing small price movements, linear charts may suffice. However, for long-term investments and growth analysis, logarithmic charts often provide a more insightful perspective. The logarithmic stock chart free tool caters to users seeking to leverage these insights without the associated costs of premium charting services.

Advantages of Using Logarithmic Stock Charts

Logarithmic stock charts offer several advantages that make them an invaluable tool for traders and investors. One of the primary benefits is their ability to present data in a way that emphasizes percentage changes rather than absolute values. This feature is crucial for long-term trend analysis, allowing investors to identify consistent growth patterns and make informed decisions based on relative performance.

Another advantage is the ability to visualize exponential growth effectively. Stocks often experience exponential growth due to compound interest and reinvestment strategies. Logarithmic charts help depict this growth accurately, providing a clearer picture of a stock's trajectory over time. This capability is particularly useful for investors focusing on long-term growth and those seeking to understand the underlying trends driving stock performance.

Logarithmic charts also offer improved readability for stocks with large price ranges. Stocks that have undergone significant growth can appear distorted on linear charts, making it challenging to discern meaningful trends. By using a logarithmic scale, these charts present a more balanced view, enabling investors to make more informed comparisons between different stocks and market indices. The logarithmic stock chart free tool makes these advantages accessible to all investors, regardless of their experience level or financial resources.

Understanding the Logarithmic Scale

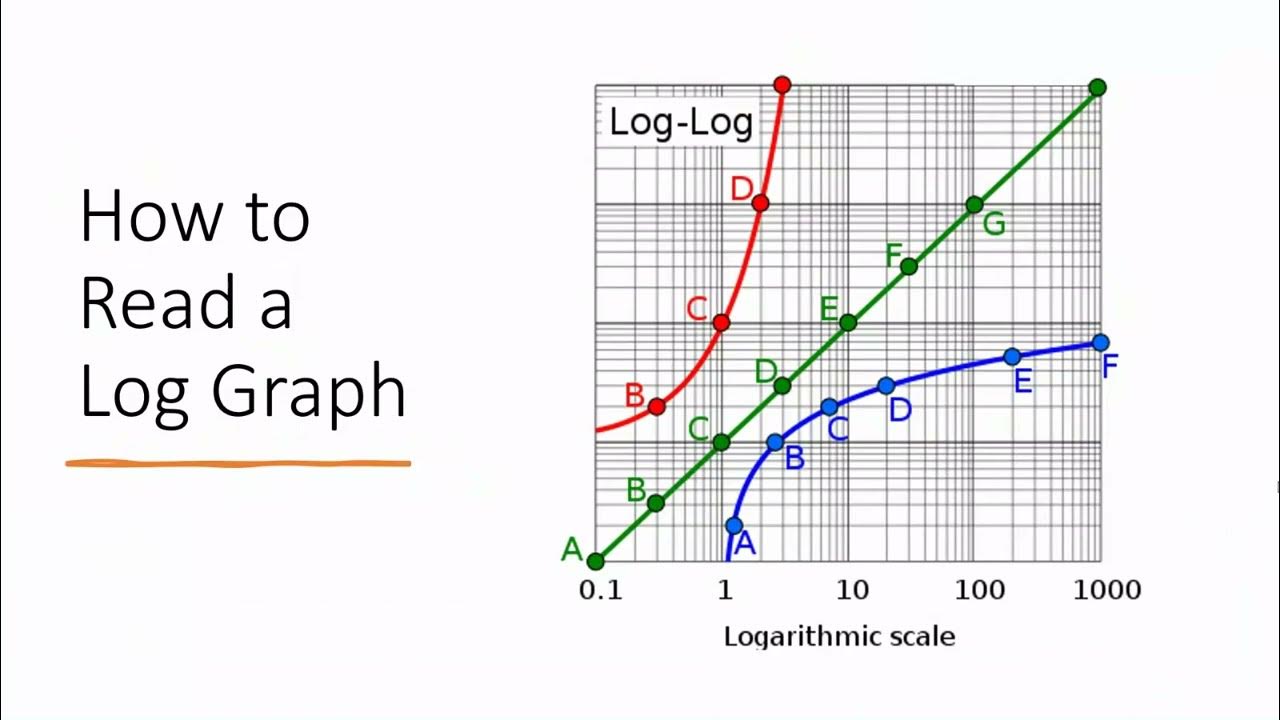

The logarithmic scale is a mathematical concept used to represent data in terms of percentage changes rather than absolute values. This scaling method is particularly useful for analyzing data that spans several orders of magnitude, such as stock prices or population growth. In a logarithmic scale, equal distances along the axis correspond to equal ratios, allowing for a more intuitive understanding of relative changes.

In the context of stock charts, the logarithmic scale enables investors to visualize trends more effectively. For example, a stock that doubles in price from $10 to $20 will appear the same as a stock that doubles from $100 to $200, as both represent a 100% increase. This scaling method allows for a more accurate representation of growth, making it easier to identify consistent patterns and trends over time.

Understanding the logarithmic scale is essential for investors looking to leverage the full potential of logarithmic stock charts. By focusing on percentage changes, these charts provide a more balanced view of stock performance, enabling investors to make more informed decisions. The logarithmic stock chart free tool offers users access to this powerful analytical capability without any associated costs, making it an ideal choice for investors of all experience levels.

Implementing Logarithmic Stock Chart Free Tool

Implementing the logarithmic stock chart free tool into your investment strategy is a straightforward process that can enhance your analytical capabilities. The first step is to identify a platform or software that offers free access to logarithmic stock charts. Many online resources provide this functionality without requiring a subscription or payment, making it accessible to all investors.

Once you have selected a platform, familiarize yourself with its interface and features. Most logarithmic chart tools offer a range of customization options, allowing you to tailor the charts to your specific needs. For instance, you can adjust the time frame, select different stocks or indices, and apply various technical indicators to gain deeper insights into market trends.

To maximize the benefits of the logarithmic stock chart free tool, consider incorporating it into your regular analysis routine. Use it alongside other chart types and analytical methods to gain a comprehensive understanding of stock performance. By comparing logarithmic charts with linear charts, you can identify trends that may not be immediately apparent on one chart type alone. This approach allows you to make more informed investment decisions and enhances your overall trading strategy.

Practical Application in Stock Analysis

The practical application of logarithmic stock charts in stock analysis is vast, offering investors a unique perspective on market trends. One of the most common uses is for analyzing the growth of stocks over extended periods. By focusing on percentage changes, logarithmic charts provide a more accurate representation of a stock's performance, allowing investors to identify long-term trends and make informed decisions.

Logarithmic charts are also useful for comparing stocks with different price ranges. Stocks that have experienced significant growth can appear distorted on linear charts, making it challenging to discern meaningful trends. By using a logarithmic scale, investors can make more informed comparisons between different stocks and market indices, gaining a clearer understanding of relative performance.

Incorporating logarithmic stock charts into your investment strategy can enhance your analytical capabilities and provide a more comprehensive view of market trends. By using the logarithmic stock chart free tool alongside other chart types and analytical methods, you can gain a deeper understanding of stock performance and make more informed investment decisions. This approach allows you to identify opportunities and manage risks more effectively, ultimately improving your overall trading strategy.

Common Misconceptions About Logarithmic Charts

Despite their numerous advantages, logarithmic stock charts are often misunderstood, leading to several common misconceptions. One of the most prevalent myths is that logarithmic charts are more complicated than linear charts. While it's true that logarithmic charts use a different scaling method, they are not inherently more difficult to understand. In fact, many investors find logarithmic charts easier to read, as they emphasize percentage changes and provide a more balanced view of stock performance.

Another misconception is that logarithmic charts are only useful for long-term analysis. While it's true that logarithmic charts excel at depicting long-term trends, they can also be valuable for short-term analysis. By focusing on percentage changes, logarithmic charts allow investors to identify meaningful patterns and trends, regardless of the time frame.

Finally, some investors believe that logarithmic charts are less accurate than linear charts. This is not the case, as logarithmic charts simply represent data differently. By emphasizing percentage changes, logarithmic charts provide a more accurate representation of growth, allowing investors to make more informed decisions. The logarithmic stock chart free tool offers users access to these insights without any associated costs, making it an ideal choice for investors of all experience levels.

Case Studies and Real-World Examples

To illustrate the effectiveness of logarithmic stock charts, let's explore several case studies and real-world examples. These examples demonstrate how logarithmic charts can provide valuable insights into stock performance and help investors make more informed decisions.

One notable example is the analysis of technology stocks over the past two decades. During this period, many technology companies experienced significant growth, with stock prices increasing exponentially. By using logarithmic charts, investors can visualize this growth more accurately, identifying consistent patterns and trends that may not be immediately apparent on linear charts. This insight allows investors to make more informed decisions about when to buy or sell technology stocks, ultimately enhancing their overall investment strategy.

Another example is the comparison of stocks from different industries. By using logarithmic charts, investors can make more informed comparisons between stocks with different price ranges, gaining a clearer understanding of relative performance. This approach allows investors to identify opportunities and manage risks more effectively, ultimately improving their overall trading strategy.

These case studies and real-world examples highlight the value of logarithmic stock charts in stock analysis. By providing a more accurate representation of growth and emphasizing percentage changes, logarithmic charts offer investors a unique perspective on market trends. The logarithmic stock chart free tool offers users access to these insights without any associated costs, making it an ideal choice for investors of all experience levels.

Integrating Logarithmic Charts into Investment Strategy

Integrating logarithmic charts into your investment strategy can enhance your analytical capabilities and provide a more comprehensive view of market trends. By using logarithmic charts alongside other chart types and analytical methods, you can gain a deeper understanding of stock performance and make more informed investment decisions.

One way to integrate logarithmic charts into your strategy is by using them to identify long-term trends. By focusing on percentage changes, logarithmic charts provide a more accurate representation of growth, allowing you to identify consistent patterns and trends over time. This insight can help you make more informed decisions about when to buy or sell stocks, ultimately enhancing your overall investment strategy.

Another approach is to use logarithmic charts for comparing stocks with different price ranges. By using a logarithmic scale, you can make more informed comparisons between different stocks and market indices, gaining a clearer understanding of relative performance. This approach allows you to identify opportunities and manage risks more effectively, ultimately improving your overall trading strategy.

By incorporating logarithmic charts into your investment strategy, you can enhance your analytical capabilities and gain a more comprehensive view of market trends. The logarithmic stock chart free tool offers users access to these insights without any associated costs, making it an ideal choice for investors of all experience levels.

Tools and Platforms Offering Free Logarithmic Charts

There are several online tools and platforms that offer free access to logarithmic stock charts. These resources provide investors with the ability to analyze stock performance using logarithmic scaling, without the financial commitment of premium charting services. Here are some popular platforms that offer this functionality:

- TradingView: A widely used platform that offers a range of chart types, including logarithmic charts. TradingView provides users with access to real-time data and a variety of analytical tools, making it an ideal choice for investors seeking comprehensive charting capabilities.

- Yahoo Finance: A popular financial news and data website that offers free access to logarithmic stock charts. Yahoo Finance provides users with a range of customization options, allowing them to tailor charts to their specific needs.

- Google Finance: A free financial news and data service that offers access to logarithmic stock charts. Google Finance provides users with a simple and intuitive interface, making it an ideal choice for investors of all experience levels.

- StockCharts.com: A platform offering free access to a variety of chart types, including logarithmic charts. StockCharts.com provides users with a range of technical indicators and customization options, making it a valuable resource for investors seeking in-depth analysis.

- Finviz: A financial visualization platform that offers access to logarithmic stock charts. Finviz provides users with a range of analytical tools and customization options, making it an ideal choice for investors seeking comprehensive charting capabilities.

These platforms offer investors access to logarithmic stock charts without any associated costs, making them an ideal choice for those looking to enhance their analytical toolkit. By utilizing these resources, investors can gain valuable insights into stock performance and make more informed investment decisions.

Step-by-Step Guide to Using Logarithmic Stock Chart Free Tool

Using a logarithmic stock chart free tool can enhance your investment strategy by providing valuable insights into stock performance. Here is a step-by-step guide to help you get started:

- Select a Platform: Choose an online platform that offers free access to logarithmic stock charts. Popular choices include TradingView, Yahoo Finance, and Google Finance.

- Create an Account: Sign up for an account on your chosen platform, if required. This step is often necessary to access advanced features and customization options.

- Familiarize Yourself with the Interface: Take some time to explore the platform's interface and features. Most platforms offer a range of customization options, allowing you to tailor the charts to your specific needs.

- Select a Stock or Index: Choose a stock or market index that you wish to analyze. Enter the stock symbol or index name into the platform's search bar to access the relevant data.

- Switch to Logarithmic Scale: Adjust the chart settings to display data using a logarithmic scale. This option is typically found in the chart settings or customization menu.

- Analyze the Chart: Use the logarithmic chart to analyze stock performance. Focus on percentage changes to identify meaningful patterns and trends over time.

- Integrate with Other Analysis Tools: Use the logarithmic chart alongside other analytical tools and chart types to gain a comprehensive understanding of stock performance.

By following these steps, you can effectively use a logarithmic stock chart free tool to enhance your investment strategy and gain valuable insights into stock performance.

Comparing Popular Logarithmic Chart Tools

When selecting a logarithmic stock chart free tool, it's essential to consider the features and capabilities offered by different platforms. Here is a comparison of some popular options:

- TradingView: Offers a wide range of chart types, including logarithmic charts, with access to real-time data and a variety of technical indicators. Provides extensive customization options and a user-friendly interface.

- Yahoo Finance: Offers free access to logarithmic stock charts, with a simple and intuitive interface. Provides a range of customization options, making it suitable for investors of all experience levels.

- Google Finance: Offers free access to logarithmic stock charts with a straightforward interface. Provides basic customization options and access to real-time data.

- StockCharts.com: Offers a variety of chart types, including logarithmic charts, with access to technical indicators and customization options. Provides a comprehensive charting experience for in-depth analysis.

- Finviz: Offers access to logarithmic stock charts with a range of analytical tools and customization options. Provides a user-friendly interface suitable for investors seeking comprehensive charting capabilities.

By comparing these platforms, you can select the logarithmic stock chart free tool that best meets your analytical needs and enhances your investment strategy.

Future Trends in Stock Chart Technology

The field of stock chart technology is continually evolving, with new developments and trends emerging regularly. Some of the most notable trends in this area include the integration of artificial intelligence (AI) and machine learning, the use of big data analytics, and the increasing availability of mobile charting tools.

AI and machine learning are playing an increasingly significant role in stock chart technology, offering investors new ways to analyze data and identify trends. These technologies can process vast amounts of data quickly, providing insights that may not be immediately apparent through traditional analysis methods. By incorporating AI and machine learning into stock chart tools, investors can gain a more comprehensive understanding of market trends and make more informed decisions.

Big data analytics is another trend shaping the future of stock chart technology. By leveraging large datasets, investors can gain deeper insights into stock performance and market trends. This approach allows for more accurate and informed decision-making, ultimately enhancing overall investment strategies.

The increasing availability of mobile charting tools is also transforming the field of stock chart technology. With the rise of mobile devices, investors now have access to powerful charting tools on the go, allowing them to analyze stock performance and make informed decisions from anywhere. This trend is expected to continue, with more platforms offering mobile-friendly charting options in the future.

These trends highlight the dynamic nature of stock chart technology and the potential for continued innovation in this field. By staying informed about these developments, investors can enhance their analytical capabilities and gain a competitive edge in the market.

Frequently Asked Questions

1. What is a logarithmic stock chart?

A logarithmic stock chart is a type of chart that represents data in terms of percentage changes rather than absolute values. This scaling method is particularly useful for analyzing long-term trends and visualizing exponential growth.

2. How does a logarithmic chart differ from a linear chart?

A logarithmic chart uses a scale where equal distances represent equal percentage changes, while a linear chart displays absolute price changes. Logarithmic charts are ideal for analyzing long-term trends and stocks with large price ranges.

3. Why should I use a logarithmic stock chart?

Logarithmic stock charts provide a more accurate representation of growth and emphasize percentage changes, making them valuable for long-term trend analysis and comparing stocks with different price ranges.

4. Are logarithmic stock charts free?

Yes, many online platforms offer free access to logarithmic stock charts, allowing investors to analyze stock performance without the financial commitment of premium charting services.

5. Can I use logarithmic charts for short-term analysis?

Yes, logarithmic charts can be valuable for short-term analysis by focusing on percentage changes and identifying meaningful patterns and trends, regardless of the time frame.

6. What are some popular platforms offering free logarithmic charts?

Popular platforms offering free logarithmic charts include TradingView, Yahoo Finance, Google Finance, StockCharts.com, and Finviz. These platforms provide a range of analytical tools and customization options.

Conclusion

In conclusion, the logarithmic stock chart free tool is an invaluable resource for investors seeking to enhance their analytical capabilities and gain a comprehensive understanding of stock performance. By emphasizing percentage changes and providing a more accurate representation of growth, logarithmic charts offer a unique perspective on market trends, making them ideal for long-term trend analysis and comparing stocks with different price ranges.

By incorporating logarithmic charts into your investment strategy, you can make more informed decisions and gain a competitive edge in the market. With the availability of free logarithmic charting tools on platforms such as TradingView, Yahoo Finance, and Google Finance, investors of all experience levels can access these insights without financial commitments.

As the field of stock chart technology continues to evolve, staying informed about emerging trends and developments can further enhance your analytical capabilities and investment strategy. By leveraging the power of logarithmic stock charts, you can gain valuable insights into stock performance and make more informed decisions in your trading endeavors.

You Might Also Like

Weighing The Advantages And Disadvantages Of Dual Dental InsuranceUltimate Guide To Free HD TV Streaming: Everything You Need To Know

Honest Truth Behind Warrior Trading Success

Mastering The Art Of Identifying Unusual Option Flow With Market Chameleon

Michael Cline's Fortune: Net Worth And Influence

Article Recommendations