Cryptocurrency has become an integral part of modern financial markets, with Bitcoin leading the charge as the most recognized digital currency. As Bitcoin's value continues to fluctuate, understanding how to convert Bitcoin to traditional currency, such as the US Dollar (USD), becomes crucial for investors and enthusiasts alike. In this article, we'll delve into the intricacies of converting 0.2 BTC to USD, providing you with a comprehensive guide on the current value, factors influencing Bitcoin's price, and how to make informed decisions in the ever-evolving crypto landscape.

Bitcoin's price is notoriously volatile, subject to rapid changes due to various factors including market demand, regulatory developments, and global economic conditions. This volatility can present both opportunities and challenges for those looking to convert their Bitcoin holdings into USD. By understanding the dynamics that drive Bitcoin's price, you can better anticipate market trends and make informed choices about when to convert your Bitcoin to USD, maximizing your potential returns.

Whether you're a seasoned Bitcoin investor or a newcomer to the world of cryptocurrencies, this article will provide you with valuable insights and practical knowledge on converting 0.2 BTC to USD. We'll explore key concepts such as exchange rates, transaction fees, and market trends, equipping you with the tools you need to navigate the cryptocurrency market with confidence. So, let's dive into the fascinating world of Bitcoin and discover how to effectively convert 0.2 BTC to USD.

Table of Contents

- Bitcoin: An Overview

- History of Bitcoin

- Understanding Bitcoin Value

- How Bitcoin Price is Determined

- The Importance of Exchange Rates

- Calculating 0.2 BTC to USD

- Factors Affecting Bitcoin Price

- Impact of Regulations on Bitcoin

- Bitcoin Market Trends

- Converting Bitcoin to USD: A Step-by-Step Guide

- Understanding Transaction Fees

- Risk Management in Crypto Trading

- Frequently Asked Questions

- Conclusion

Bitcoin: An Overview

Bitcoin, the first and most prominent cryptocurrency, was created in 2009 by an anonymous figure known as Satoshi Nakamoto. It introduced a decentralized digital currency system, operating without a central authority, such as a government or financial institution. Bitcoin transactions are secured by cryptography and recorded on a public ledger called the blockchain, which ensures transparency and immutability.

Bitcoin's popularity stems from its potential as a store of value and a medium of exchange, offering an alternative to traditional fiat currencies. Its decentralized nature means that users can transact directly with one another, bypassing intermediaries and reducing transaction costs. Furthermore, Bitcoin's fixed supply of 21 million coins creates scarcity, which can drive up its value over time.

Despite its advantages, Bitcoin is not without its challenges. Its price is highly volatile, and its use as a currency is still limited compared to traditional fiat currencies. Nevertheless, Bitcoin's influence on the financial world is undeniable, and understanding its workings is essential for anyone interested in the future of money.

History of Bitcoin

The history of Bitcoin is a fascinating tale of innovation, controversy, and speculation. In 2008, a white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" was published under the pseudonym Satoshi Nakamoto. The paper outlined the concept of a decentralized digital currency, paving the way for the creation of Bitcoin in 2009.

In the early years, Bitcoin was primarily used by tech enthusiasts and libertarians who valued its potential to disrupt traditional financial systems. The first known commercial transaction using Bitcoin occurred in 2010 when a programmer purchased two pizzas for 10,000 BTC, illustrating the currency's initial low value.

As Bitcoin gained popularity, its price began to rise, attracting investors and speculators. In 2013, Bitcoin experienced its first major price surge, reaching over $1,000 per BTC. However, this rapid growth also led to increased scrutiny from regulators and governments, resulting in fluctuating prices and market instability.

Despite these challenges, Bitcoin has continued to grow, with its price reaching all-time highs in recent years. Its journey from a niche digital currency to a mainstream financial asset demonstrates the transformative potential of cryptocurrencies.

Understanding Bitcoin Value

The value of Bitcoin is influenced by a myriad of factors, ranging from market demand to macroeconomic trends. One of the primary drivers of Bitcoin's value is its scarcity. With a capped supply of 21 million coins, Bitcoin is often compared to gold as a "digital gold," offering a hedge against inflation and economic uncertainty.

Market demand also plays a crucial role in determining Bitcoin's value. As more individuals and institutions adopt Bitcoin, its demand increases, potentially driving up its price. Additionally, Bitcoin's value is influenced by investor sentiment, which can be swayed by news events, technological advancements, and regulatory developments.

Another key factor affecting Bitcoin's value is its utility. As more businesses and services accept Bitcoin as a form of payment, its value as a medium of exchange increases. However, Bitcoin's utility is currently limited compared to traditional fiat currencies, which can impact its overall value.

Understanding these factors is essential for anyone looking to invest in Bitcoin or convert their Bitcoin holdings into USD. By staying informed about market trends and developments, you can make more informed decisions about when to buy, sell, or convert your Bitcoin.

How Bitcoin Price is Determined

Bitcoin's price is determined by the dynamics of supply and demand in the cryptocurrency market. Unlike traditional fiat currencies, which are influenced by central banks and government policies, Bitcoin's price is primarily driven by market forces.

When demand for Bitcoin increases, its price tends to rise. Conversely, when demand decreases, its price may fall. This supply-demand relationship is influenced by a variety of factors, including investor sentiment, macroeconomic trends, and geopolitical events.

Additionally, Bitcoin's price is affected by the availability of Bitcoin on exchanges. If there is a limited supply of Bitcoin available for trading, its price may increase as buyers compete for the available coins. Conversely, if there is an oversupply of Bitcoin on exchanges, its price may decrease as sellers compete to offload their holdings.

It's important to note that Bitcoin's price can vary across different exchanges due to differences in supply and demand dynamics. As a result, it's essential to compare prices across multiple exchanges when converting Bitcoin to USD to ensure you get the best rate.

The Importance of Exchange Rates

Exchange rates play a critical role in determining the value of Bitcoin when converting it to USD or other fiat currencies. An exchange rate is the price at which one currency can be exchanged for another, and it can fluctuate based on market conditions and economic factors.

When converting Bitcoin to USD, the exchange rate will determine how much USD you receive for your Bitcoin holdings. A favorable exchange rate can maximize your returns, while an unfavorable rate can reduce the value of your conversion.

It's important to monitor exchange rates and choose the right time to convert your Bitcoin to USD. Additionally, different exchanges may offer slightly different rates, so it's essential to compare rates across multiple platforms to ensure you get the best deal.

Calculating 0.2 BTC to USD

Calculating the value of 0.2 BTC to USD involves understanding the current exchange rate between Bitcoin and USD. The exchange rate is influenced by various factors, including market demand, investor sentiment, and geopolitical events.

To calculate the value of 0.2 BTC to USD, you need to determine the current exchange rate and multiply it by the amount of Bitcoin you wish to convert. For example, if the current exchange rate is $50,000 per BTC, the value of 0.2 BTC would be $10,000 (0.2 x 50,000).

It's important to note that exchange rates can fluctuate rapidly, so it's essential to check the current rate before making any conversions. Additionally, exchange rates may vary across different platforms, so it's a good idea to compare rates to ensure you get the best deal.

Factors Affecting Bitcoin Price

Several factors can influence the price of Bitcoin, making it a highly volatile asset. Understanding these factors can help you make informed decisions about when to convert your Bitcoin to USD.

- Market Demand: As demand for Bitcoin increases, its price tends to rise. Conversely, when demand decreases, its price may fall. Market demand is influenced by investor sentiment, macroeconomic trends, and geopolitical events.

- Regulatory Developments: Changes in regulations and government policies can impact Bitcoin's price. For example, news of a country adopting Bitcoin as legal tender or imposing strict regulations on cryptocurrency exchanges can influence market sentiment and drive price fluctuations.

- Technological Advancements: Developments in blockchain technology and improvements to Bitcoin's infrastructure can impact its price. For example, the implementation of the Lightning Network, which aims to improve Bitcoin's scalability and transaction speed, can increase its utility and drive up its price.

- Macroeconomic Trends: Economic factors, such as inflation, interest rates, and currency fluctuations, can influence Bitcoin's price. As a decentralized digital currency, Bitcoin is often seen as a hedge against inflation and economic uncertainty, which can drive up demand during times of economic instability.

- Market Speculation: Speculative trading can lead to rapid price fluctuations, as traders buy and sell Bitcoin based on short-term price movements. This speculation can create volatility in the market, impacting the value of Bitcoin.

Impact of Regulations on Bitcoin

Regulations play a significant role in shaping the cryptocurrency market, influencing the price and adoption of Bitcoin. Government policies and regulatory developments can impact investor sentiment, market demand, and the overall perception of Bitcoin as a financial asset.

For example, positive regulatory news, such as a country adopting Bitcoin as legal tender or implementing favorable cryptocurrency regulations, can boost market confidence and drive up Bitcoin's price. Conversely, negative regulatory developments, such as crackdowns on cryptocurrency exchanges or bans on Bitcoin transactions, can create uncertainty and lead to price declines.

It's essential to stay informed about regulatory developments and understand their potential impact on Bitcoin's price. By keeping an eye on news and updates from government agencies and regulatory bodies, you can better anticipate market trends and make informed decisions about your Bitcoin investments.

Bitcoin Market Trends

Bitcoin market trends can provide valuable insights into the future direction of Bitcoin's price and its potential as an investment. Analyzing market trends involves examining historical price data, trading volumes, and other key indicators to identify patterns and predict future price movements.

One common trend in the Bitcoin market is the cyclical nature of price surges and corrections. Bitcoin has experienced several major bull runs, followed by significant price corrections, as market sentiment and demand fluctuate. Understanding these cycles can help investors make informed decisions about when to buy or sell Bitcoin.

Another trend to consider is the growing institutional interest in Bitcoin. As more institutional investors and financial institutions enter the cryptocurrency market, demand for Bitcoin is likely to increase, potentially driving up its price. Additionally, the development of Bitcoin-related financial products, such as exchange-traded funds (ETFs), can increase accessibility and attract more investors to the market.

By staying informed about market trends and developments, you can better anticipate future price movements and make informed decisions about your Bitcoin investments.

Converting Bitcoin to USD: A Step-by-Step Guide

Converting Bitcoin to USD involves several steps, from choosing the right exchange platform to executing the transaction. Here's a step-by-step guide to help you navigate the process:

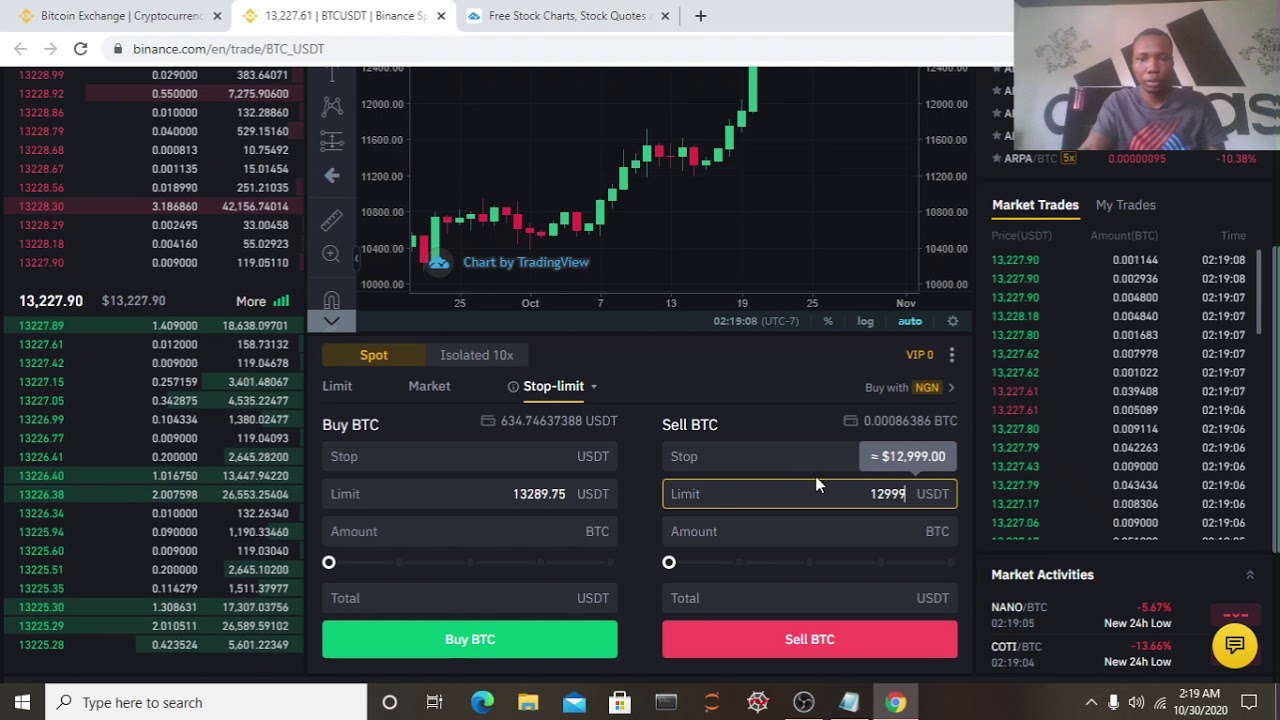

- Select an Exchange Platform: Choose a reputable cryptocurrency exchange that supports Bitcoin-to-USD conversions. Popular exchanges include Coinbase, Binance, and Kraken. Compare exchange rates, fees, and security features to select the best platform for your needs.

- Create an Account: Sign up for an account on the chosen exchange platform and complete the necessary verification process. This may involve providing identification documents and verifying your email address.

- Deposit Bitcoin: Transfer your Bitcoin holdings to your exchange account. This typically involves sending Bitcoin from your wallet to your exchange's wallet address.

- Check the Current Exchange Rate: Before executing the transaction, check the current exchange rate between Bitcoin and USD to ensure you get the best deal.

- Execute the Conversion: Place an order to sell your Bitcoin for USD. You can choose between a market order, which executes at the current market price, or a limit order, which executes at a specified price.

- Withdraw USD: Once the conversion is complete, withdraw the USD to your bank account or another payment method supported by the exchange.

By following these steps, you can successfully convert your Bitcoin holdings to USD and take advantage of favorable market conditions.

Understanding Transaction Fees

Transaction fees are an important consideration when converting Bitcoin to USD, as they can impact the overall value of your conversion. These fees are charged by cryptocurrency exchanges and the Bitcoin network to process transactions and maintain the blockchain.

Exchange platforms typically charge a fee for executing trades, which can vary based on the platform and the size of the transaction. It's essential to compare fees across different exchanges to ensure you get the best deal.

In addition to exchange fees, Bitcoin transactions also incur network fees, which are paid to miners for processing and validating transactions on the blockchain. These fees can fluctuate based on network congestion and demand.

To minimize transaction fees, consider using exchanges with competitive fee structures and executing transactions during periods of low network congestion. By understanding and managing transaction fees, you can maximize the value of your Bitcoin-to-USD conversions.

Risk Management in Crypto Trading

Risk management is a crucial aspect of successful crypto trading, as the volatile nature of the cryptocurrency market can lead to significant price fluctuations. Implementing effective risk management strategies can help you protect your investments and minimize potential losses.

One common risk management strategy is diversification, which involves spreading your investments across multiple cryptocurrencies or asset classes. This can help reduce the impact of price fluctuations in any single asset on your overall portfolio.

Another strategy is setting stop-loss orders, which automatically sell your holdings if the price drops to a predetermined level. This can help limit potential losses and protect your investments during periods of market volatility.

It's also important to stay informed about market trends and developments, as well as to regularly review and adjust your investment strategy based on changing market conditions. By implementing effective risk management strategies, you can navigate the crypto market with confidence and maximize your potential returns.

Frequently Asked Questions

1. What is the current exchange rate for 0.2 BTC to USD?

The exchange rate for 0.2 BTC to USD can fluctuate based on market conditions. It's essential to check the current rate on a reputable cryptocurrency exchange before making any conversions.

2. How can I convert 0.2 BTC to USD?

To convert 0.2 BTC to USD, choose a reputable cryptocurrency exchange, create an account, deposit your Bitcoin, and execute the conversion. Be sure to check the current exchange rate and compare fees across different platforms.

3. What factors influence Bitcoin's price?

Bitcoin's price is influenced by various factors, including market demand, regulatory developments, technological advancements, macroeconomic trends, and market speculation. Understanding these factors can help you make informed investment decisions.

4. Are there any fees associated with converting Bitcoin to USD?

Yes, there are fees associated with converting Bitcoin to USD, including exchange fees and network transaction fees. It's important to compare fees across different platforms to ensure you get the best deal.

5. How can I manage risk when trading Bitcoin?

To manage risk when trading Bitcoin, consider diversifying your investments, setting stop-loss orders, and staying informed about market trends and developments. Implementing effective risk management strategies can help protect your investments and minimize potential losses.

6. Is Bitcoin a good investment?

Bitcoin can be a good investment for those who are willing to accept its inherent volatility and potential risks. It's important to conduct thorough research and understand the factors influencing Bitcoin's price before making any investment decisions.

Conclusion

In conclusion, understanding the conversion of 0.2 BTC to USD is essential for anyone involved in the cryptocurrency market. By staying informed about market trends, exchange rates, and transaction fees, you can make informed decisions and maximize the value of your Bitcoin holdings. Whether you're a seasoned investor or a newcomer to the world of cryptocurrencies, this guide provides valuable insights to help you navigate the complex and ever-evolving crypto landscape with confidence.

As the cryptocurrency market continues to grow and evolve, staying informed and adapting to changing conditions will be key to success. By understanding the factors influencing Bitcoin's price and implementing effective risk management strategies, you can make the most of your investments and achieve your financial goals.

Remember, the cryptocurrency market is highly volatile, and prices can fluctuate rapidly. It's essential to conduct thorough research, stay informed, and make informed decisions based on your risk tolerance and investment objectives. With the right knowledge and strategies, you can navigate the world of Bitcoin and cryptocurrencies with confidence and success.

You Might Also Like

Connect Invest Reviews: The Ultimate Guide To Smart InvestingSeamless Calculation: 100 000 Divided By 12 Explained

Expert Tips For Managing Finances: The Ultimate Home Finance Blog Guide

Mastering The Art Of Identifying Unusual Option Flow With Market Chameleon

Mastering The 757 Engine Start Gate Process: Essential Insights

Article Recommendations