Determining Jon Bernthal's financial status requires examination of public records, income sources, and lifestyle. Public information regarding wealth for actors is often limited and indirect. Anecdotal evidence or speculation cannot provide a definitive answer. A comprehensive analysis of a celebrity's financial situation is multifaceted and requires access to private information which is usually not available to the public.

Investigating a celebrity's financial status can be valuable in understanding the complex interplay between fame, career choices, and personal finances. It can illuminate the realities of the entertainment industry and contribute to a more nuanced understanding of economic factors impacting individuals within that sphere. Such inquiry can help to understand how success translates into material wealth and highlight the various avenues individuals utilize to achieve or maintain a certain economic standing.

This exploration of a celebrity's financial situation is a starting point for further investigation into the specifics of career earnings, tax information, spending patterns, and asset holdings. Further investigation may be possible depending on available public information. A broader examination of wealth disparity in the entertainment industry would encompass an analysis of successful individuals and compare them to those less fortunate, and potentially help in the development of policies that better support the needs of performers.

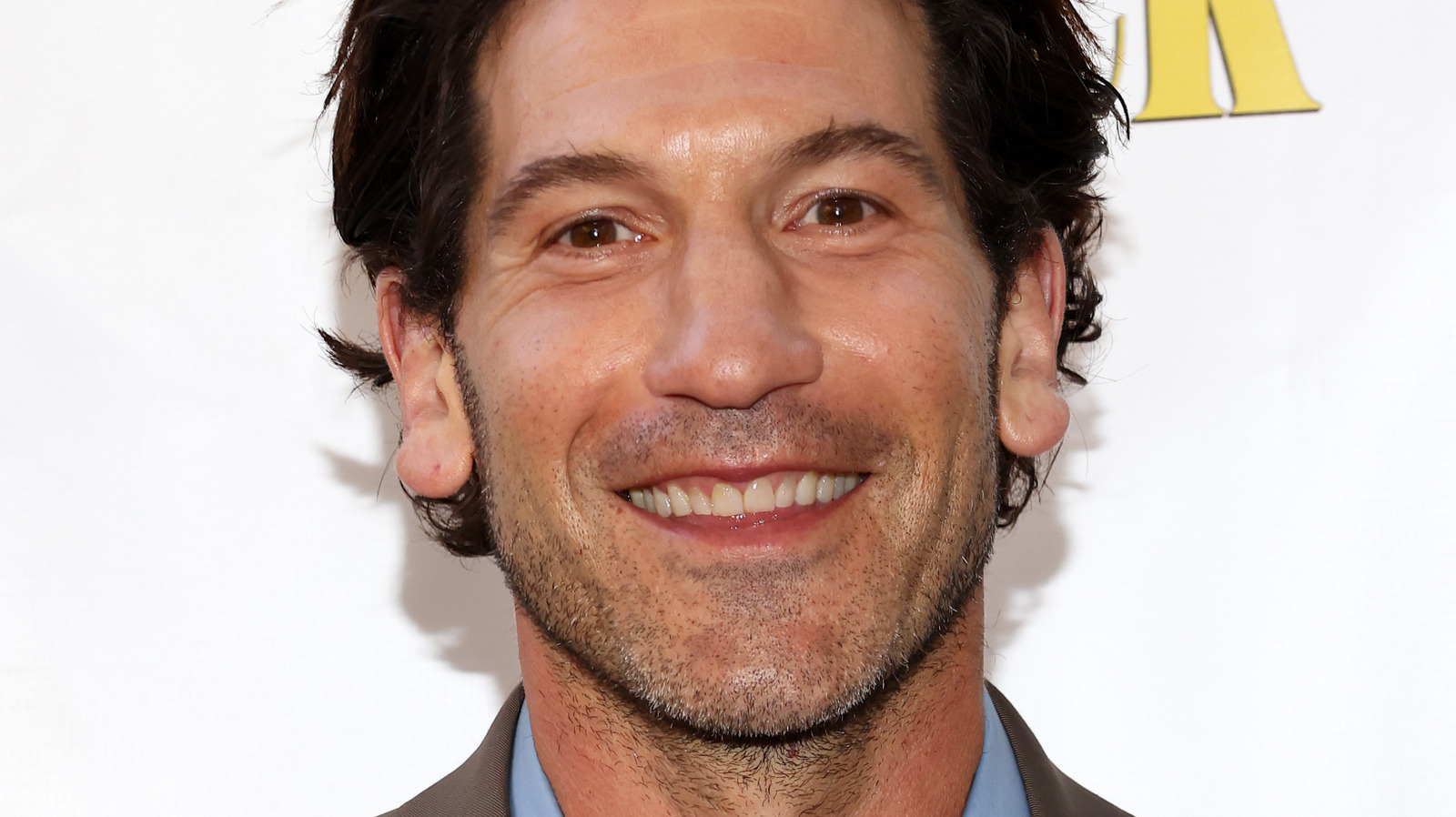

Was Jon Bernthal Wealthy?

Assessing Jon Bernthal's financial status requires a nuanced approach, considering multiple factors beyond simple affirmation or denial. The question implies a need to examine evidence supporting a determination of his overall wealth.

- Income sources

- Career trajectory

- Investment strategies

- Public information

- Lifestyle choices

- Asset holdings

- Tax records (if available)

- Financial disclosures

Determining an actor's wealth necessitates careful consideration of their career progression and income streams. Factors like recurring roles, successful film projects, and savvy investments significantly impact an actor's financial situation. Public information, such as observed lifestyle choices or reported earnings, offers a partial view, while access to private financial documents provides a more comprehensive understanding. The overall complexity of wealth evaluation applies equally to public figures and average individuals. Consequently, speculation or conjecture lacks the depth of a conclusive assessment based on verifiable evidence.

1. Income sources

Analyzing Jon Bernthal's income sources is crucial for evaluating his overall financial standing. Income streams, encompassing salaries, bonuses, residuals from previous projects, and potential investments, are key indicators of accumulated wealth. The magnitude and consistency of these sources directly influence the likelihood of significant financial accumulation. Actors often receive salaries for individual projects and may earn residuals from subsequent airings or streaming releases. The presence of substantial income from these sources, along with other possible avenues such as endorsements or product placements, supports the supposition of a substantial financial position.

Variety in income streams enhances financial security. A reliance on a single, comparatively lower income source makes financial stability more precarious. Conversely, diverse income sources provide a buffer against market fluctuations or career interruptions. Successful actors often cultivate various income streams throughout their career. This can include recurring roles, high-demand performances, or lucrative projects. Careful examination of the type and volume of income sources reveals potential wealth accumulation. If Jon Bernthal's income is demonstrably high, consistent, and diverse, the likelihood of substantial wealth increases.

The importance of income sources in assessing wealth is undeniable. Financial records and public reporting can provide insights into the potential for wealth accumulation. Without direct access to such records, assessing the specifics of Jon Bernthal's financial situation remains challenging. Further research, incorporating industry standards, salary expectations, and potential investments, could offer a more comprehensive understanding. Careful evaluation of an individual's income sources helps in forming a reasoned judgment about their financial status. This aspect forms an essential component of any in-depth analysis of economic standing.

2. Career Trajectory

A performer's career trajectory significantly influences their potential for wealth accumulation. Factors like the longevity of a successful career, the types of roles undertaken, and the ability to secure high-paying opportunities directly impact an individual's financial standing. Analyzing Jon Bernthal's career path provides valuable context for evaluating the likelihood of substantial wealth.

- Role Variety and Demand

The range of roles Jon Bernthal has undertaken and the perceived demand for those roles influence potential income. If his career has primarily encompassed high-demand roles in major productions or recurring high-profile parts, it suggests a higher likelihood of significant financial gain. Conversely, a career consisting largely of smaller or less demanding roles might indicate a comparatively lower financial trajectory. The types of rolesaction, dramatic, comediccan also affect salary potential.

- Longevity and Consistency

A long and consistent career in a high-demand field often translates into higher earnings. A steady stream of projects, including recurring roles or consistent appearances in notable films/television shows, demonstrates an ability to generate income over time. This consistency in income streams directly impacts accumulated wealth. Conversely, a career with significant gaps or limited project appearances might suggest a less robust financial trajectory.

- Strategic Career Choices

Strategic career choices, such as taking on roles in popular franchises, participating in lucrative film productions, or negotiating high salaries, directly impact potential wealth. Actors who can effectively negotiate favorable terms and participate in projects with considerable financial returns are more likely to achieve significant wealth. Conversely, choices that prioritize creative fulfillment over financial gain might lead to a different economic outcome.

- Industry Recognition and Awards

Industry accolades and awards can influence both perceived value and potential career advancement and income. Recognition and awards, such as nominations or wins for prestigious awards, suggest a level of industry respect that often correlates with increased opportunities for high-paying projects and broader career advancement. This increased exposure and recognition can attract greater income potential.

The trajectory of Jon Bernthal's career, including the variety of roles, longevity of employment, strategic choices, and industry recognition, significantly informs the assessment of potential wealth. While career trajectory doesn't definitively determine an individual's financial standing, it serves as a crucial element for understanding and contextualizing wealth potential within a specific field and for an individual in question.

3. Investment Strategies

Investment strategies play a crucial role in determining an individual's financial standing, particularly for high-earning professionals like actors. The ability to manage assets and capital through prudent investment strategies contributes to wealth accumulation. Assessing Jon Bernthal's wealth involves exploring the potential application and success of his investment strategies.

- Diversification of Investments

Diversifying investment portfolios across different asset classesstocks, bonds, real estate, and potentially alternative investmentsmitigates risk. A diverse portfolio can withstand market fluctuations and enhance long-term growth potential. For individuals with significant income, diversification becomes crucial to preserving and expanding wealth. Effective diversification strategies can shield investments from catastrophic losses. Examples from the entertainment industry showcase this principle: successful actors often employ investment professionals to diversify their portfolio, avoiding concentration in a single asset class. Understanding the specific investment choices, or lack thereof, made by Jon Bernthal is pertinent to determining the overall level of his wealth.

- Risk Tolerance and Approach

Investment strategies should align with risk tolerance. A high-risk strategy might involve substantial investments in speculative assets, while a low-risk approach focuses on more stable investments like bonds. Understanding the strategies chosen reveals a potential indicator of their financial temperament and appetite for risk. A thoughtful investment strategy often reflects an understanding of the potential benefits and downsides associated with different approaches. A cautious investor might prefer a more stable investment approach to maintain existing capital, whereas an aggressive investor might prioritize potential high returns. Understanding Jon Bernthal's risk tolerance can shed light on his wealth-building strategy.

- Professional Management and Expertise

Engaging financial advisors and investment professionals enables access to specialized knowledge and resources. These professionals can provide guidance on asset allocation, market analysis, and risk management. Employing experts ensures a professional approach to investments, leading to potentially better outcomes. Jon Bernthal's reliance on professionals, if any, is a crucial aspect for evaluating the sophistication and prudence of his investment approach. The presence or absence of such counsel could indicate a different approach to building and managing wealth.

- Time Horizon and Goals

Long-term investment strategies focused on retirement or wealth building necessitate a distinct approach from short-term goals. The investment time horizon significantly influences asset allocation and strategy. A longer time horizon often warrants a more aggressive approach to investment, accepting higher risk for potentially higher returns. The suitability of investment strategies can be evaluated in light of the overall financial goals. Analyzing Jon Bernthal's financial goals and time horizon can provide a clearer picture of his investment approach and its potential impact on his overall wealth.

Evaluating Jon Bernthal's investment strategies is crucial in understanding his overall financial situation. The effectiveness and sophistication of his investment approach, along with the factors outlined above, contribute to a comprehensive assessment of his wealth. Further research on specific investment holdings or public declarations might provide more insight.

4. Public information

Public information plays a crucial role in assessing wealth, particularly when direct financial data is unavailable. Publicly accessible data, while often incomplete, can offer indicators of potential wealth. This encompasses observable lifestyle choices, reported earnings, and appearances in high-profile projects. The absence of such indicators, conversely, can suggest a lower likelihood of significant wealth. The value of this type of information lies in its capacity to provide a broad, general picture of financial standing. However, it's vital to remember that this information is often indirect and doesn't definitively establish the full extent of a celebrity's wealth.

Consider a celebrity with frequent appearances in expensive productions, ownership of high-value properties, or consistent engagement in charitable endeavors. Such visible indicators might suggest significant wealth, although precise financial figures remain unavailable. Conversely, if a celebrity primarily appears in budget-friendly productions, favors modest accommodation, and avoids ostentatious displays, public perception might lean towards a less substantial financial position. Crucially, public perception shouldn't substitute meticulous analysis of verifiable financial information.

Recognizing the limitations of public information is vital. Observing a celebrity's public persona, while suggestive, cannot provide definitive answers about their financial status. A comprehensive assessment of wealth requires more than just publicly available clues. The absence of certain public indicators, however, can be seen as evidence that the individual is not publicly displaying signs of conspicuous wealth. Therefore, public information serves as a supplementary tool in forming an educated guess regarding a subject's overall financial standing; it's not a sufficient basis for definitive conclusions. A reasoned understanding necessitates a combined perspective that incorporates publicly available data with other potential sources of information.

5. Lifestyle Choices

Lifestyle choices, while not definitive proof, can offer valuable indirect clues regarding an individual's financial status. Observations of a celebrity's lifestyle, encompassing housing, transportation, travel, and recreational pursuits, can provide context for potential wealth accumulation. This analysis requires careful consideration, as lifestyle choices can also be influenced by personal preferences and career demands. However, consistent patterns can offer insights into the potential economic resources available to an individual.

- Residential Situation

The type and location of residences can provide a window into financial capacity. High-value properties in desirable locations might suggest substantial wealth. Conversely, modest homes or rental properties might imply a more moderate financial standing. It's important to note the contextual difference between purchasing and renting and how lifestyle factors can influence housing choices. Comparing Jon Bernthal's reported living arrangements with those of peers in the entertainment industry or the general population can be a partial indicator of potential wealth relative to other individuals.

- Travel and Recreation

Travel patterns, the frequency and scale of travel, and the types of recreational pursuits an individual engages in can offer insight into spending habits and economic means. Frequent travel to luxurious destinations or the ownership of high-end recreational vehicles and equipment are potentially indicative of substantial financial resources. Assessing the cost of these activities helps in formulating an understanding of how travel choices might reflect an individual's overall economic standing. This can be partially evaluated by comparing the frequency and type of travel with data from similar actors within the entertainment industry or the general population. This provides context for the financial implications associated with these choices.

- Consumption Habits

Observations of spending habits, such as the frequency of purchases of luxury items, or involvement in high-cost leisure activities can suggest a potentially high financial standing. Analyzing the frequency, types, and value of purchases, when compared to similar figures or the general population, offers a potential context. This can reveal the scale and nature of consumption habits, highlighting possible implications for wealth levels. Again, lifestyle can be influenced by factors other than financial means, so this analysis is a complex facet.

In conclusion, while lifestyle choices are not conclusive evidence of wealth, the observable patterns and comparisons within those choices provide potentially valuable, indirect insights into an individual's financial status. The absence of expensive possessions or lavish activities does not negate the potential for wealth. Examining lifestyle choices within a broader context can assist in developing a more nuanced understanding of potential financial capacity, when considered alongside other facets like career trajectory and investment strategies.

6. Asset Holdings

Examining asset holdings is a critical component in assessing an individual's overall wealth, particularly when evaluating a public figure like Jon Bernthal. Asset holdings represent tangible and intangible possessions that contribute to an individual's financial standing and provide a more complete picture of economic status. Public disclosure of asset holdings, while often limited for privacy reasons, offers valuable insight into financial capacity, potentially illuminating the question of whether Jon Bernthal possesses significant wealth.

- Real Estate Holdings

The presence and value of real estate holdings, such as homes, land, or investment properties, are significant indicators of wealth. Ownership of properties, particularly in high-value locations, could suggest substantial financial resources. Analysis of comparable properties within the same area and market can provide some perspective. The presence or absence of luxury properties, alongside similar assets held by other actors, provides a contextual basis for evaluating wealth potential.

- Investment Portfolios

Detailed information about investment portfolios is often unavailable to the public. Investments in stocks, bonds, mutual funds, or other financial instruments contribute to overall wealth accumulation. The size and diversification of an investment portfolio offer important clues regarding an individual's financial preparedness and the potential for long-term wealth generation. The presence or absence of documented portfolios, along with the types of investments held, provides a lens through which to view potential wealth generation.

- Vehicles and Collectibles

The acquisition and ownership of luxury vehicles, art, or other collectibles can offer glimpses into an individual's financial capacity. The value of these items often varies widely, reflecting the potential for significant value accumulation. The nature and quantity of such possessions, when considered in conjunction with other indicators, can contribute to an understanding of the individual's overall financial standing. An actor's collection of memorabilia or prized vehicles might provide a different angle on their potential asset holdings. Publicly accessible images of an individual's possessions can provide circumstantial evidence to assist in forming an understanding of financial capability.

- Other Assets

Other assets such as intellectual property rights (e.g., copyrights, trademarks), business interests, or other investments can contribute to an individual's overall wealth. Analysis of these assets is complex, requiring investigation into their value and potential return. The presence of documented or verifiable holdings of such assets further adds to a complete evaluation of wealth. Exploring potential ownership of patents, trademarks, or copyrights can shed light on another dimension of an actor's portfolio of assets.

Considering asset holdings, particularly the types, values, and diversification of these assets, allows for a deeper evaluation of overall wealth. The absence of readily available information regarding these holdings doesn't automatically negate the possibility of wealth, but it does limit the depth of analysis. A comprehensive assessment requires combining this facet with insights from career trajectory, income, and public information for a more complete understanding of an individual's overall financial standing.

7. Tax records (if available)

Tax records, when available, are crucial for determining an individual's financial situation, including wealth. They provide a detailed, documented history of income, deductions, and tax liabilities. This information directly reflects an individual's financial activity and can be a critical component in assessing wealth, demonstrating the importance of verifiable financial data. Without access to such records, inferences about wealth are inherently less certain and potentially misleading. Tax records provide evidence-based understanding rather than speculation.

The significance of tax records extends beyond simply listing income. They reveal patterns in income generation, deductions reflecting potential asset holdings (e.g., mortgage interest, charitable contributions), and overall financial management strategies. Tax records serve as a comprehensive record of financial transactions over a period of time. These records can be scrutinized to identify trends, evaluate overall income stability, assess the extent of investments and other financial activities, and, in certain circumstances, potentially expose specific assets. This comprehensive view is valuable for evaluating the validity and reliability of statements or claims about an individual's financial standing. For public figures, scrutiny of tax records is essential for maintaining transparency and public trust, particularly when their wealth is a subject of interest or debate.

In evaluating "was Jon Bernthal wealthy," access to his tax records (if publicly available) would be instrumental. This information, revealing detailed income statements, deductions, and tax payments over a specific period, offers critical insights into the nature and extent of his financial activity and, potentially, the scale of his accumulated wealth. Such records, if accessible, would provide undeniable evidence to support or refute claims about his financial standing. The absence of publicly available tax records, however, does not definitively negate the possibility of wealth but limits the strength of any conclusion drawn solely from other forms of indirect evidence. Understanding the implications of readily available or unavailable tax records allows a more nuanced approach to evaluating financial standing for any public figure.

8. Financial disclosures

Financial disclosures, when available, are crucial in evaluating the financial standing of public figures like Jon Bernthal. They represent a formal presentation of financial information, providing a structured overview of income sources, assets, and liabilities. The potential for disclosure directly impacts the assessment of wealth. Thorough financial disclosures, meticulously documented, offer a more accurate understanding of financial status. The absence of such disclosures hinders a definitive evaluation.

The importance of financial disclosures stems from their ability to substantiate claims or refute assumptions about wealth. A detailed financial disclosure, including specifics about income, investments, and assets, lends credibility to assessments of wealth. Conversely, a lack of disclosure may be interpreted as a reluctance to demonstrate wealth or as indicative of a complex financial situation requiring privacy. However, the absence of disclosure does not necessarily imply a lack of wealth. An individual might be wealthy but choose not to publicize financial details for personal or strategic reasons. Examples might include a desire for privacy, the strategic avoidance of unwanted public attention, or the complexity of an individual's financial affairs. Therefore, drawing definitive conclusions from the absence of financial disclosure alone is inappropriate.

The practical significance of understanding financial disclosures lies in their ability to provide a more complete picture of an individual's financial situation. By examining income statements, detailed asset reports, and liabilities, a comprehensive view of financial status emerges, contrasting with speculation or inference. This understanding is valuable in various contexts, from media reporting to investment analysis. This detailed, verifiable documentation counters speculative accounts. Ultimately, robust financial disclosure promotes transparency and accountability, allowing for a reasoned and fact-based assessment of an individual's economic standing. However, it is equally crucial to recognize the limitations of financial disclosures, as they do not always present a wholly comprehensive or accurate portrayal of an individual's economic reality. This is particularly relevant in sectors like entertainment, where incomes and assets can be complex, volatile, and susceptible to confidentiality concerns.

Frequently Asked Questions about Jon Bernthal's Wealth

This section addresses common inquiries regarding Jon Bernthal's financial status. Direct answers to questions regarding wealth necessitate access to private information, which is typically unavailable. Therefore, responses rely on publicly available data and reasoned analysis of publicly visible trends.

Question 1: Is Jon Bernthal wealthy?

A definitive answer regarding Jon Bernthal's wealth is not possible without access to private financial records. Publicly available data, while offering clues, cannot provide a conclusive answer. Observational evidence such as lifestyle choices and career trajectory suggests a potential for significant wealth accumulation, yet lacks the detail to determine the exact financial standing.

Question 2: What factors influence an actor's wealth?

Several factors contribute to an actor's financial status, including recurring roles, high-profile projects, lucrative contracts, endorsements, and investments. The longevity and consistency of a successful career, coupled with shrewd financial management, are significant indicators. A diverse range of income streams, rather than dependence on a single source, can increase financial security.

Question 3: How can career trajectory indicate wealth potential?

A successful and consistently high-profile career trajectory suggests potential for wealth accumulation. This encompasses factors such as securing prominent roles in popular films or television series, the consistent demand for their services, and negotiating favorable compensation terms. Consistent career advancement often correlates with increased financial stability.

Question 4: What role do investments play in wealth accumulation?

Investment strategies significantly impact wealth. Diversifying investment portfolios, carefully assessing risk tolerance, and utilizing professional financial advisors can enhance wealth accumulation potential. Individuals with substantial income often employ a structured approach to investment management.

Question 5: How do public indicators suggest potential wealth?

Publicly observable indicators, like high-value properties, expensive vehicles, or participation in high-profile projects, can suggest a degree of financial capacity. However, such indicators cannot definitively determine the exact extent of wealth or the overall financial health of an individual. Public perception is not definitive proof.

Question 6: What are the limitations of evaluating wealth without access to private records?

Without access to private financial records, an assessment of wealth is necessarily incomplete. Publicly available information offers clues, but it is not a comprehensive measure of an individual's financial standing. Speculation and conjecture cannot replace verifiable financial data.

In conclusion, assessing wealth without comprehensive financial records relies on publicly available information, which often provides only a partial picture. Evaluating potential wealth requires a multi-faceted analysis incorporating a variety of observable indicators, acknowledging the limitations of such indirect assessment.

This section concludes the FAQ section and transitions to the following discussion on assessing wealth.

Tips for Evaluating Wealth

Evaluating an individual's wealth, especially in the case of public figures like Jon Bernthal, requires careful consideration of available information. A comprehensive assessment necessitates considering various factors rather than relying on superficial indicators. The following tips provide guidance on a methodical evaluation process.

Tip 1: Scrutinize Income Sources. Identifying and analyzing income sources is fundamental. Consider recurring roles, film and television appearances, residuals, endorsements, and potential investments. The volume, consistency, and diversification of income streams significantly impact overall wealth accumulation. For instance, a steady stream of high-paying roles, combined with smart investments, suggests a higher likelihood of substantial wealth compared to a career with fewer high-demand projects.

Tip 2: Analyze Career Trajectory. A performer's career progression reveals valuable insights. Assess the longevity, consistency, and types of roles undertaken throughout the career. A consistent, high-profile career trajectory involving prominent roles and substantial projects indicates a higher potential for wealth. Conversely, a career with frequent gaps or featuring predominantly supporting roles could suggest a less substantial financial profile.

Tip 3: Investigate Asset Holdings. Directly assessing asset holdings is crucial. Look at potential real estate holdings, investments in stocks, bonds, or other financial instruments, and the presence of other assets like vehicles or collectibles. The value and nature of these holdings offer further insight into the level of wealth.

Tip 4: Scrutinize Public Information. Publicly available information can provide indirect indicators of wealth. Consider a performer's lifestyle choices, appearances in high-profile projects, and reported earnings, if available. Analyzing these indicators alongside career trajectory and other factors can aid in forming a more comprehensive understanding of potential wealth.

Tip 5: Evaluate Investment Strategies. An individual's investment approach significantly impacts wealth. Look for evidence of diversification, risk tolerance, and the use of financial advisors. A sophisticated and diversified investment strategy suggests a greater likelihood of wealth preservation and growth.

Tip 6: Examine Tax Records (if available). Tax records, when accessible, offer crucial, documented insight into financial activity. They reveal income patterns, deductions, and tax liabilities, shedding light on the extent of wealth accumulation and the nature of financial management.

Tip 7: Interpret Financial Disclosures. Financial disclosures, when available, offer a formal overview of financial standing. Detailed information regarding income, assets, and liabilities provides a more detailed and direct view of financial capacity and potential wealth.

Applying these tips methodically allows for a more thorough and evidence-based approach to evaluating wealth. Critically examining various aspects, rather than relying on singular indicators, provides a more complete understanding of an individual's financial situation. This meticulous approach is crucial when assessing wealth, particularly when dealing with complex situations or limited public information.

Further research into similar individuals and market trends may prove valuable in the overall context of an assessment.

Conclusion Regarding Jon Bernthal's Wealth

Determining Jon Bernthal's financial status necessitates a multifaceted approach, considering various factors beyond superficial observations. Analysis of income sources, career trajectory, asset holdings, and public information provides a more nuanced understanding of potential wealth. While observable lifestyle choices and high-profile projects can suggest a capacity for accumulation, these indicators alone do not constitute conclusive proof. The absence of direct financial disclosures or tax records limits the scope of definitive conclusions. Ultimately, evaluating wealth requires a comprehensive examination of verifiable information, rather than reliance on conjecture or speculation. A reasoned assessment must consider the complex interplay of income, career choices, investment strategies, and publicly available data.

The exploration of Jon Bernthal's financial situation underscores the complexities inherent in evaluating wealth, particularly in the context of public figures. The pursuit of comprehensive understanding requires meticulous attention to detail and a recognition of the limitations of publicly available information. A critical approach, incorporating verifiable evidence rather than relying solely on assumptions, is paramount in forming a balanced evaluation of an individual's financial standing. Further research and analysis, particularly the availability of comprehensive financial records, would contribute significantly to a more definitive understanding.

You Might Also Like

Biggie Baddies: Age Ranges & MoreJason Oppenheim Height: How Tall Is He?

Phil Mattingly Net Worth 2023: Estimated

Hall And Oates Net Worth: 2024 Update & Facts

Cool Pineapple Brat Names & Ideas

Article Recommendations