Introduction to Ledgers

In the world of finance and accounting, the term "ledger" holds a pivotal place. A ledger is essentially a book or a digital record used to track and maintain all financial transactions of a business or an individual. It provides a comprehensive and detailed account of every financial transaction, categorized by accounts. This foundational tool is crucial for any organization as it helps in maintaining the financial health of the company by ensuring accuracy in financial reporting and compliance with regulatory standards. Understanding the definition and functionality of ledgers is vital for both seasoned accountants and those new to the field. As we move further into 2024, the traditional concepts of ledgers continue to evolve, adapting to the digital age and the growing complexity of business transactions.

The Evolution of Ledgers

Historically, ledgers were maintained manually, with entries meticulously recorded in physical books. This traditional method, though effective, was prone to human error and required substantial time and resources. However, with the advent of technology, ledgers have undergone significant transformation. The digital revolution has introduced electronic ledgers, which are now commonly used in accounting software and enterprise resource planning (ERP) systems. These digital ledgers not only reduce the possibility of errors but also enhance efficiency and accuracy. In 2024, blockchain technology is further revolutionizing the concept of ledgers by introducing decentralized ledgers, which offer enhanced security and transparency, making them increasingly popular in various sectors including finance, healthcare, and logistics.

The Structure of a Ledger

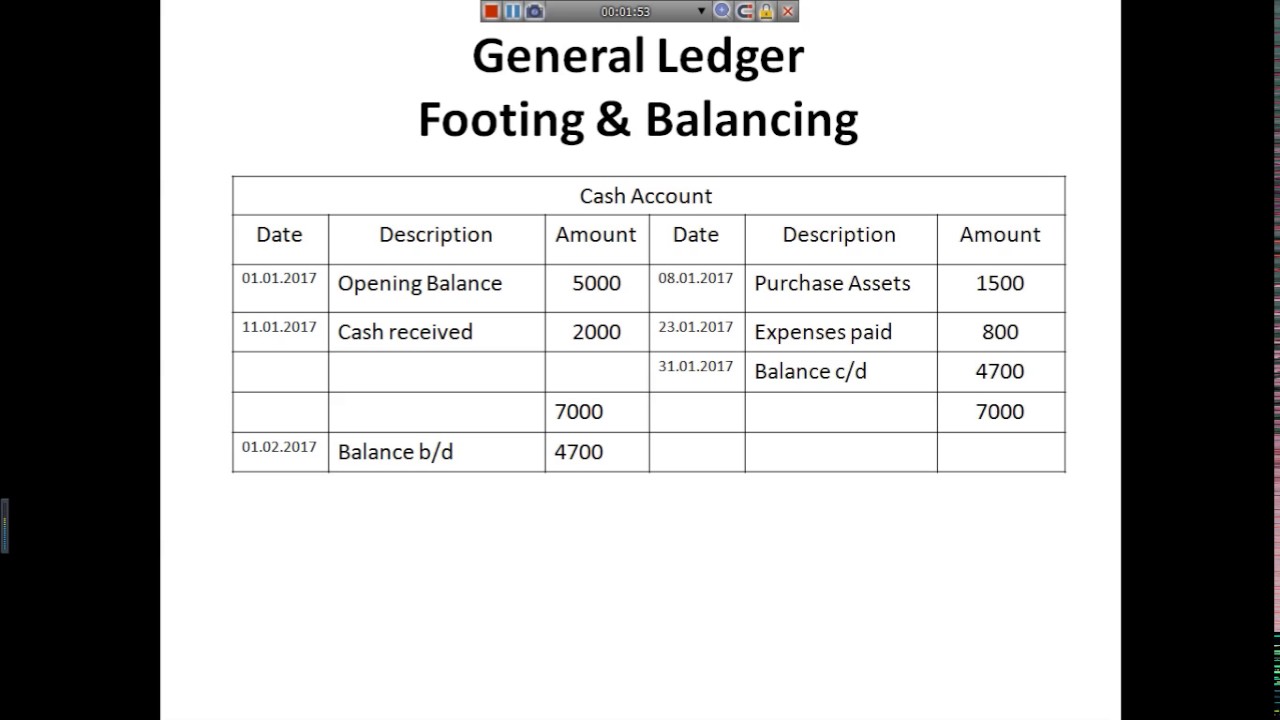

A ledger is structured into various accounts, each representing a category of transaction. These accounts are usually divided into two main types: debit and credit. Debit entries represent assets or expenses that increase with a debit entry, whereas credit entries represent liabilities, equity, or income that increase with a credit entry. Each transaction recorded in the ledger affects at least two accounts, a practice known as double-entry bookkeeping, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced. Within a ledger, common accounts include cash, accounts receivable, inventory, accounts payable, and equity. Understanding the structure of a ledger is crucial for accurate financial tracking and reporting.

Read also:Jimmie Walkers Net Worth Behind His Financial Success

The Importance of Ledgers in Business

Ledgers play an indispensable role in the financial management of a business. They provide a clear and organized view of a company’s financial activities, aiding in decision-making processes. By maintaining accurate and up-to-date ledger records, businesses can monitor cash flow, track income and expenses, and prepare financial statements with ease. This not only assists in internal management but also ensures compliance with external audits and regulatory requirements. Furthermore, ledgers help in identifying financial trends, forecasting future financial performance, and formulating strategic plans. In 2024, as businesses face increasing financial complexities and regulatory scrutiny, maintaining a robust ledger system is more critical than ever.

Types of Ledgers

There are several types of ledgers, each serving a distinct purpose within the accounting framework. The general ledger is the most comprehensive type, containing all the accounts for recording transactions related to a company’s assets, liabilities, equity, income, and expenses. Sub-ledgers, on the other hand, provide detailed information on specific accounts, such as accounts receivable, accounts payable, and fixed assets. These sub-ledgers feed into the general ledger, ensuring a consolidated view of financial data. Additionally, specialized ledgers like sales ledgers and purchase ledgers focus on specific areas of business transactions. Understanding the different types of ledgers is crucial for effective financial management and reporting.

The Role of Technology in Ledger Management

Technology has significantly impacted the way ledgers are managed in the contemporary business environment. Advanced accounting software and cloud-based solutions have made ledger management more efficient and secure. These tools offer real-time data processing, automated entries, and integration with other business systems, reducing the manual workload and minimizing errors. Moreover, blockchain technology is emerging as a transformative force in ledger management, providing decentralized and immutable records that enhance transparency and trust. As we navigate through 2024, leveraging technological advancements in ledger management will be essential for businesses to stay competitive and compliant.

Common Challenges in Ledger Management

Despite the advancements in technology, managing ledgers still presents several challenges. One of the primary issues is the risk of data inaccuracies due to human error, especially during manual data entry. Another challenge is maintaining data security, as financial information is sensitive and prone to cyber threats. Additionally, ensuring compliance with ever-evolving accounting standards and regulations can be daunting for businesses. In 2024, these challenges are compounded by the increasing volume of financial transactions and the complexity of global business operations. Addressing these challenges requires a combination of robust internal controls, regular audits, and adopting cutting-edge technology solutions.

Best Practices for Effective Ledger Management

To ensure accurate and efficient ledger management, businesses should adopt several best practices. Firstly, implementing a standardized chart of accounts can help maintain consistency and clarity across financial records. Regular reconciliation of ledger accounts is crucial to identify and rectify discrepancies promptly. Additionally, investing in reliable accounting software can automate processes and enhance data accuracy. Training employees on the latest accounting standards and technologies is also vital to ensure compliance and efficiency. Lastly, conducting periodic audits and reviews can help identify areas for improvement and mitigate potential risks. By following these best practices, businesses can maintain robust and reliable ledger systems.

The Future of Ledgers

As we look towards the future, the role of ledgers in financial management is set to evolve further. The integration of artificial intelligence and machine learning in accounting systems promises to enhance the accuracy and efficiency of ledger management. Predictive analytics will enable businesses to forecast financial trends and make informed decisions. Moreover, the continued adoption of blockchain technology will transform ledger systems, providing decentralized and tamper-proof records. As businesses adapt to these innovations, they must remain agile and embrace change to harness the full potential of future ledger systems. The future of ledgers in 2024 and beyond holds exciting possibilities for enhanced financial transparency and control.

Read also:The Newest Dairy Queen Blizzard Of The Month A Sweet Treat You Wont Want To Miss

Conclusion

In conclusion, understanding the definition and functionality of ledgers is essential for effective financial management. Whether in traditional or digital form, ledgers provide a comprehensive and organized view of financial transactions, aiding in decision-making and regulatory compliance. As we progress through 2024, the role of ledgers continues to evolve, driven by technological advancements and increasing business complexities. By adopting best practices and embracing new technologies, businesses can optimize their ledger management processes and ensure financial accuracy and integrity. As the financial landscape continues to change, staying informed and adaptable will be key to leveraging the full potential of ledgers in the years to come.