Introduction to CPI

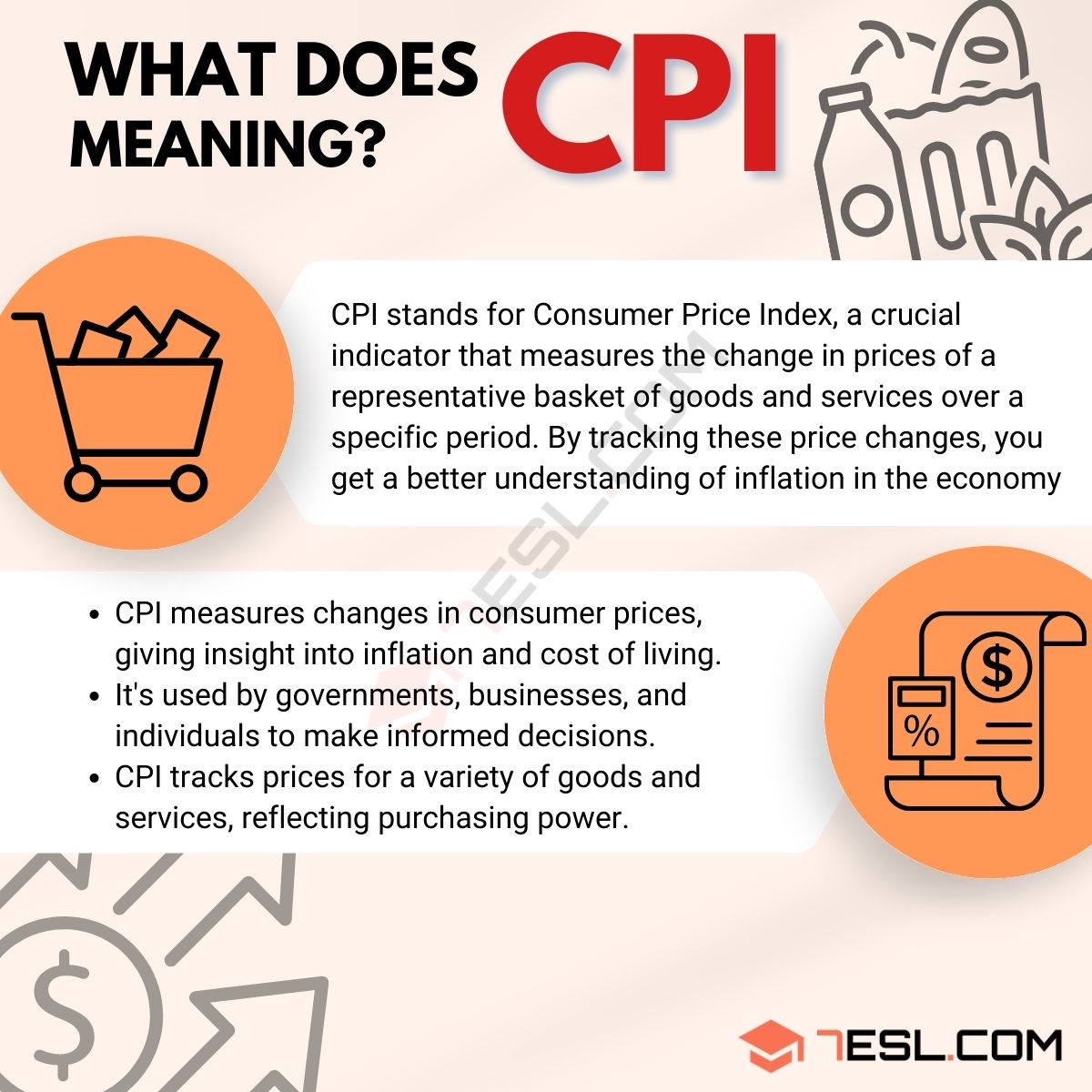

The term "CPI" is often thrown around in economic discussions, but what does it really mean? CPI stands for Consumer Price Index, and it serves as a critical economic indicator. It provides a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. In simpler terms, CPI is a statistical estimate that helps us understand how the cost of living changes over time. This metric is crucial for economists, policymakers, and businesses as it helps gauge inflation levels and informs decisions related to economic policy and business strategy.

The Importance of CPI

The Consumer Price Index is important for several reasons. First and foremost, it is a key indicator of inflation. Inflation, or the rate at which the general level of prices for goods and services rises, eroding purchasing power, is a critical economic factor. By tracking CPI, economists and policymakers can make informed decisions to stabilize the economy. Additionally, CPI impacts everyday life as it influences how much money people need to maintain their current standard of living. It also plays a role in adjusting income payments, such as social security benefits, to keep up with the cost of living. Understanding CPI is therefore essential in both a personal finance and broader economic context.

How CPI is Calculated

The calculation of CPI involves a complex process managed by national statistics agencies. Typically, it involves gathering data on the prices of a representative basket of goods and services. This basket reflects the consumption habits of a typical urban consumer. Items in the basket are categorized into various groups such as food, housing, clothing, transportation, and healthcare. The prices of these items are collected periodically, and the CPI is calculated by comparing the current prices to the prices in a base year. The result is expressed as an index number. Changes in the CPI can indicate whether prices are rising or falling, providing valuable insight into economic trends.

Read also:A Look Into The Bond Between Kim Porter And Tupac

Components of the CPI Basket

The CPI basket includes a wide range of goods and services that urban consumers typically purchase. Each category in the basket is weighted based on the average consumer's spending patterns. Major components include food and beverages, housing, apparel, transportation, medical care, recreation, education, and communication. Each component is crucial as it reflects different aspects of the economy. For example, housing costs are significant because they represent a large portion of consumer expenditure. Similarly, transportation costs can influence the CPI due to their impact on commuting and freight costs. The weighting of each component can change over time as consumer habits evolve, ensuring the CPI remains relevant and accurate.

CPI and Cost of Living

One of the primary uses of CPI is to assess changes in the cost of living. As prices increase, the amount of money needed to maintain a certain standard of living also rises. This can affect various aspects of life, such as wages, pensions, and personal savings. Employers may use CPI data to adjust salaries to match inflation, ensuring employees maintain their purchasing power. Similarly, government programs often use CPI to adjust benefits, such as social security, to protect beneficiaries from inflation's erosive effects. Understanding CPI helps individuals and businesses plan for the future, ensuring they can maintain their desired lifestyle despite changing economic conditions.

Limitations of CPI

While CPI is a valuable tool, it is not without its limitations. One of the primary criticisms is that it may not accurately reflect the cost of living for all individuals, as it is based on average urban consumer patterns. People in different geographic locations or with different spending habits may experience different inflation rates. Additionally, CPI does not account for changes in consumer behavior in response to price changes, such as substituting cheaper goods for more expensive ones. Furthermore, the quality of goods and services can change over time, affecting their value and the accuracy of CPI as a measure of inflation. Despite these limitations, CPI remains a widely used and essential economic indicator.

Comparing CPI to Other Economic Indicators

CPI is just one of several economic indicators used to assess inflation and economic health. Another important measure is the Producer Price Index (PPI), which tracks changes in selling prices received by domestic producers for their output. While CPI measures the prices consumers pay, PPI focuses on the prices at the wholesale level. Additionally, the Gross Domestic Product (GDP) deflator is another measure of inflation, reflecting changes in the price level of all domestically produced goods and services. Each indicator provides unique insights into the economy, and understanding their differences can help in making well-rounded economic analyses.

CPI in Global Context

CPI is not only significant for individual countries but also important in a global context. Different countries calculate their own CPIs, and these can be used to compare inflation rates internationally. Such comparisons can inform decisions related to international trade and investment. For instance, if a country has a high CPI compared to its trading partners, it may experience a decrease in export competitiveness due to higher local prices. Conversely, a lower CPI may attract foreign investment. Understanding CPI in a global context is crucial for making informed decisions in an increasingly interconnected world economy.

Future Trends in CPI

As we move into 2024, several trends may impact CPI. Technological advancements continue to transform how goods and services are produced and consumed, which can influence prices and inflation. Additionally, global events such as geopolitical tensions, pandemics, or climate change can disrupt supply chains, affecting the cost of goods. Another factor is the ongoing shift towards sustainable and green economies, which may impact the cost structures of various industries. Keeping an eye on these trends will be important for predicting CPI changes and preparing for potential economic shifts.

Read also:Jimmie Walkers Net Worth Behind His Financial Success

Conclusion

In conclusion, understanding the meaning of CPI is crucial for anyone interested in economics, finance, or even personal budgeting. As a key measure of inflation, it provides valuable insights into economic health and helps inform a wide range of decisions. While it has its limitations, CPI remains an essential tool for assessing cost of living changes and making economic comparisons both domestically and internationally. As we look to the future, staying informed about CPI and related trends will be vital for navigating the ever-changing economic landscape of 2024 and beyond.

:max_bytes(150000):strip_icc()/consumerpriceindex_final-2bbbfc247d8e48c5b73b8b9a3d151a16.png)