When it comes to retirement planning, knowledge is power. The Roth IRA offers unique benefits that can help you build a substantial nest egg for your golden years. Unlike traditional retirement accounts, contributions to a Roth IRA are made with after-tax dollars, allowing your investments to grow tax-free. This means that when you reach retirement age, you can withdraw your funds without worrying about paying taxes on your gains. Additionally, the flexibility of a Roth IRA allows you to contribute at any age, making it an attractive option for individuals who plan to continue working beyond traditional retirement age. Whether you're just starting your career or are a seasoned professional nearing retirement, a Roth IRA can be an essential part of your financial strategy. By contributing to a Roth IRA, you're not only investing in your future but also taking advantage of current tax laws to maximize your savings. With proper planning and a clear understanding of how a Roth IRA works, you can enjoy a comfortable retirement and achieve your long-term financial goals.

| Table of Contents |

|---|

| 1. Understanding the Basics of a Roth IRA |

| 2. Key Features and Benefits of a Roth IRA |

| 3. Eligibility and Contribution Limits |

| 4. How to Open and Fund a Roth IRA |

| 5. Investment Options within a Roth IRA |

| 6. Tax Implications and Advantages |

| 7. Comparing Roth IRA with Traditional IRA |

| 8. Roth IRA Conversion Strategies |

| 9. Withdrawal Rules and Penalties |

| 10. Maximizing Your Roth IRA Contributions |

| 11. Common Mistakes to Avoid with Roth IRAs |

| 12. Retirement Planning and Roth IRAs |

| 13. FAQs about Roth IRAs |

| 14. Future of Roth IRAs and Retirement Planning |

| 15. Conclusion: Is a Roth IRA Right for You? |

Understanding the Basics of a Roth IRA

A Roth IRA, or Individual Retirement Account, is a type of retirement savings plan that offers unique tax advantages. Established under the Taxpayer Relief Act of 1997, the Roth IRA allows individuals to contribute after-tax dollars to their retirement savings, enabling their investments to grow tax-free. Unlike traditional IRAs, which tax withdrawals during retirement, Roth IRAs provide tax-free withdrawals, provided certain conditions are met.

One of the major benefits of a Roth IRA is its flexibility. Contributions can be made at any age, as long as the account holder has earned income. This makes it an appealing option for people who continue to work beyond the traditional retirement age. Additionally, Roth IRAs do not have required minimum distributions (RMDs), allowing account holders to let their investments grow for as long as they like. This can be especially beneficial for those who wish to pass on their savings to heirs.

It's important to note that while contributions to a Roth IRA are not tax-deductible, the potential for tax-free growth and withdrawals makes it an attractive option for many investors. By understanding how a Roth IRA works, you can make informed decisions about your retirement savings strategy and take advantage of the unique benefits it offers.

Key Features and Benefits of a Roth IRA

The Roth IRA offers several key features and benefits that make it a popular choice for retirement savings. One of the most significant advantages is the ability to withdraw contributions tax-free at any time. This provides flexibility and peace of mind, knowing that your money is accessible in case of an emergency without incurring taxes or penalties.

Another important feature of a Roth IRA is its tax advantage. Since contributions are made with after-tax dollars, the growth within the account is tax-free. This means that when you retire, you can withdraw your funds without paying taxes on your earnings, providing significant tax savings over time. This can be particularly beneficial if you anticipate being in a higher tax bracket during retirement.

In addition to tax-free withdrawals, Roth IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). This flexibility allows you to tailor your investment strategy to align with your financial goals and risk tolerance. By diversifying your investments within a Roth IRA, you can maximize your potential for growth while minimizing risk.

Eligibility and Contribution Limits

Before opening a Roth IRA, it's important to understand the eligibility requirements and contribution limits. To qualify for a Roth IRA, you must have earned income, such as wages, salaries, or self-employment income. However, there are income limits that determine whether you can contribute to a Roth IRA in a given year.

For the 2023 tax year, single filers with a modified adjusted gross income (MAGI) of up to $144,000 can make the full contribution to a Roth IRA. If your MAGI is between $144,000 and $154,000, you may be eligible to make a reduced contribution. For married couples filing jointly, the income limit is $214,000, with a phase-out range between $214,000 and $224,000.

The contribution limit for Roth IRAs is subject to annual adjustments. For 2023, the maximum contribution limit is $6,500, with an additional catch-up contribution of $1,000 for individuals aged 50 and older. It's essential to stay informed about any changes to these limits to ensure you're maximizing your contributions and taking full advantage of the benefits offered by a Roth IRA.

How to Open and Fund a Roth IRA

Opening a Roth IRA is a straightforward process that can be completed in a few simple steps. First, you'll need to choose a financial institution to hold your account. This can be a bank, brokerage firm, or mutual fund company. It's essential to research different providers to find one that offers the investment options and fees that align with your financial goals.

Once you've selected a provider, you'll need to complete an application to open your Roth IRA. This typically involves providing personal information, such as your name, address, Social Security number, and employment details. You may also be required to designate a beneficiary for your account.

After your Roth IRA is set up, you can begin funding it by making contributions. You can contribute to your account through various methods, such as automatic transfers from your bank account or payroll deductions. It's important to stay within the annual contribution limits to avoid penalties and ensure you're maximizing your retirement savings.

Investment Options within a Roth IRA

One of the key advantages of a Roth IRA is the wide range of investment options available. Unlike some retirement accounts that limit investment choices, a Roth IRA allows you to invest in a variety of assets, including stocks, bonds, mutual funds, ETFs, and even real estate investment trusts (REITs). This flexibility enables you to diversify your portfolio and tailor your investment strategy to meet your specific financial goals and risk tolerance.

When selecting investments for your Roth IRA, it's important to consider factors such as your investment timeline, risk tolerance, and retirement goals. Younger investors with a longer time horizon may choose to invest more heavily in stocks for potential growth, while those closer to retirement may opt for more conservative investments, such as bonds or dividend-paying stocks, to preserve capital and generate income.

Regularly reviewing and adjusting your investment portfolio is essential to ensure it remains aligned with your retirement objectives. By diversifying your investments and staying informed about market trends, you can optimize your Roth IRA's performance and maximize your potential for tax-free growth.

Tax Implications and Advantages

One of the most significant advantages of a Roth IRA is its favorable tax treatment. Contributions are made with after-tax dollars, which means you won't receive a tax deduction for your contributions. However, the trade-off is that your investments grow tax-free, and qualified withdrawals during retirement are also tax-free. This can result in substantial tax savings over time, especially if you anticipate being in a higher tax bracket during retirement.

In addition to tax-free growth and withdrawals, a Roth IRA offers other tax benefits. For example, since Roth IRAs do not have required minimum distributions (RMDs), you can let your investments grow for as long as you like. This provides additional flexibility and allows you to manage your retirement income more effectively.

It's important to note that certain conditions must be met to qualify for tax-free withdrawals. Generally, you must be at least 59½ years old and have held the account for at least five years. By understanding the tax implications and advantages of a Roth IRA, you can make informed decisions about your retirement savings strategy and maximize your long-term financial goals.

Comparing Roth IRA with Traditional IRA

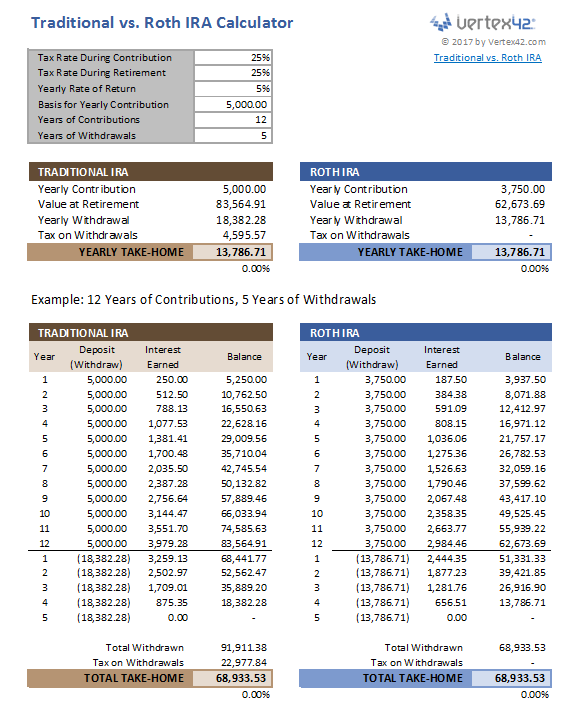

When planning for retirement, it's essential to understand the differences between a Roth IRA and a traditional IRA. While both accounts offer tax advantages, they differ in how contributions and withdrawals are taxed, as well as eligibility requirements and distribution rules.

With a traditional IRA, contributions are typically tax-deductible, reducing your taxable income for the year in which you contribute. However, withdrawals during retirement are taxed as ordinary income. In contrast, Roth IRA contributions are made with after-tax dollars, meaning they do not provide an immediate tax deduction. However, qualified withdrawals are tax-free.

Another key difference is the treatment of required minimum distributions (RMDs). Traditional IRAs require account holders to begin taking RMDs at age 72, while Roth IRAs do not have RMDs, allowing you to let your investments grow tax-free for as long as you wish.

When deciding between a Roth IRA and a traditional IRA, it's important to consider factors such as your current and future tax brackets, retirement goals, and financial situation. By understanding the differences between these accounts, you can choose the one that best aligns with your needs and maximizes your retirement savings potential.

Roth IRA Conversion Strategies

A Roth IRA conversion involves moving funds from a traditional IRA or another retirement account into a Roth IRA. This strategy can provide significant tax benefits, as it allows your investments to grow tax-free and eliminates the need for required minimum distributions (RMDs).

When considering a Roth IRA conversion, it's important to assess your current and future tax situation. Since conversions are treated as taxable events, converting funds from a traditional IRA to a Roth IRA will increase your taxable income for the year. However, this can be advantageous if you anticipate being in a higher tax bracket during retirement.

Timing is a critical factor in Roth IRA conversions. Converting during years with lower income or when taking advantage of tax loss harvesting can minimize the tax impact. Additionally, it's essential to ensure you have sufficient funds outside of the retirement account to cover the tax liability, as using retirement funds to pay taxes can negate the benefits of the conversion.

By carefully considering your tax situation and long-term retirement goals, you can implement a Roth IRA conversion strategy that maximizes your tax-free retirement savings and provides greater flexibility in managing your retirement income.

Withdrawal Rules and Penalties

Understanding the withdrawal rules and penalties of a Roth IRA is crucial to maximizing its benefits and avoiding unnecessary tax liabilities. One of the key advantages of a Roth IRA is the ability to withdraw contributions at any time, tax-free and penalty-free. However, withdrawing earnings before meeting certain conditions can result in taxes and penalties.

To qualify for tax-free and penalty-free withdrawals of earnings, you must be at least 59½ years old and have held the account for at least five years. This is known as the "five-year rule." If you withdraw earnings before meeting these requirements, you may be subject to a 10% early withdrawal penalty, in addition to ordinary income taxes on the earnings.

There are exceptions to the early withdrawal penalty, such as using the funds for a first-time home purchase (up to $10,000 lifetime limit), qualified education expenses, or certain medical expenses. By understanding the withdrawal rules and penalties of a Roth IRA, you can make informed decisions about accessing your funds and avoid unnecessary tax liabilities.

Maximizing Your Roth IRA Contributions

Maximizing your Roth IRA contributions is an essential strategy for building a substantial retirement nest egg. By contributing the maximum allowable amount each year, you can take full advantage of the tax-free growth and withdrawals offered by a Roth IRA.

To maximize your contributions, it's important to stay informed about the annual contribution limits and eligibility requirements. For the 2023 tax year, the maximum contribution limit is $6,500, with an additional catch-up contribution of $1,000 for individuals aged 50 and older. Be sure to review any changes to these limits and adjust your contributions accordingly.

Incorporating Roth IRA contributions into your overall financial plan is also crucial. Consider setting up automatic contributions from your bank account or paycheck to ensure consistent contributions throughout the year. Additionally, if you're eligible for a retirement plan at work, such as a 401(k), consider contributing to both accounts to diversify your retirement savings and maximize your tax advantages.

Common Mistakes to Avoid with Roth IRAs

While Roth IRAs offer numerous benefits, there are common mistakes that investors should avoid to ensure they're maximizing their retirement savings. One of the most frequent mistakes is not fully understanding the eligibility requirements and contribution limits. Failing to comply with these rules can result in penalties and missed opportunities for tax-free growth.

Another common mistake is not diversifying your investment portfolio within a Roth IRA. Overconcentration in a single asset class or investment can increase risk and limit your potential for growth. By diversifying your investments, you can better manage risk and optimize your portfolio's performance.

Timing is another critical factor when managing a Roth IRA. For example, withdrawing earnings before meeting the five-year rule can result in taxes and penalties. Additionally, not considering your current and future tax situation when making contributions or conversions can impact your long-term retirement goals.

By avoiding these common mistakes and staying informed about the rules and benefits of a Roth IRA, you can make the most of your retirement savings and secure a comfortable financial future.

Retirement Planning and Roth IRAs

Incorporating a Roth IRA into your retirement planning strategy can provide significant advantages and enhance your long-term financial security. By understanding the unique features and benefits of a Roth IRA, you can make informed decisions about your retirement savings and maximize your tax-free growth potential.

One of the key benefits of a Roth IRA in retirement planning is its flexibility. Unlike traditional retirement accounts, Roth IRAs do not have required minimum distributions (RMDs), allowing you to let your investments grow for as long as you wish. This provides additional flexibility in managing your retirement income and can be advantageous if you plan to work beyond the traditional retirement age.

Additionally, Roth IRAs offer tax-free withdrawals, which can provide significant tax savings during retirement. By strategically combining Roth IRA withdrawals with other sources of retirement income, such as Social Security or a pension, you can optimize your tax situation and ensure a steady income stream throughout your retirement years.

By incorporating a Roth IRA into your retirement planning strategy, you can take advantage of its unique benefits and enhance your long-term financial security. With proper planning and a clear understanding of how a Roth IRA works, you can enjoy a comfortable retirement and achieve your financial goals.

FAQs about Roth IRAs

1. What is a Roth IRA?

A Roth IRA is a type of individual retirement account that allows you to contribute after-tax dollars, enabling your investments to grow tax-free. Qualified withdrawals during retirement are also tax-free.

2. Who is eligible to contribute to a Roth IRA?

To contribute to a Roth IRA, you must have earned income and meet certain income limits. For the 2023 tax year, single filers with a modified adjusted gross income (MAGI) of up to $144,000 can make the full contribution, while those with a MAGI between $144,000 and $154,000 may be eligible for a reduced contribution.

3. What are the contribution limits for a Roth IRA?

The contribution limit for a Roth IRA in 2023 is $6,500, with an additional catch-up contribution of $1,000 for individuals aged 50 and older. These limits are subject to annual adjustments.

4. Can I withdraw my contributions from a Roth IRA at any time?

Yes, you can withdraw your contributions from a Roth IRA at any time, tax-free and penalty-free. However, withdrawing earnings before meeting certain conditions may result in taxes and penalties.

5. What is the five-year rule for Roth IRAs?

The five-year rule requires that you hold your Roth IRA for at least five years before you can make tax-free and penalty-free withdrawals of earnings. This rule applies regardless of your age when you open the account.

6. How does a Roth IRA differ from a traditional IRA?

While both accounts offer tax advantages, Roth IRAs and traditional IRAs differ in how contributions and withdrawals are taxed. Roth IRA contributions are made with after-tax dollars, allowing for tax-free growth and withdrawals during retirement. Traditional IRA contributions are typically tax-deductible, but withdrawals are taxed as ordinary income.

Future of Roth IRAs and Retirement Planning

The future of Roth IRAs and retirement planning is likely to be influenced by changing tax laws, economic conditions, and evolving financial strategies. As more individuals recognize the benefits of tax-free growth and withdrawals, Roth IRAs are expected to remain a popular choice for retirement savings.

One potential development in the future of Roth IRAs is changes to contribution limits and income eligibility requirements. As the government seeks to encourage retirement savings, adjustments to these limits may occur, providing more individuals with the opportunity to take advantage of the benefits offered by a Roth IRA.

Additionally, the continued growth of technology and financial innovation may lead to new investment options and tools for Roth IRA account holders. This could enhance the ability to diversify and optimize investment strategies, further maximizing the potential for tax-free growth.

By staying informed about changes in tax laws and retirement planning strategies, you can ensure that your Roth IRA remains a valuable component of your financial future. With proper planning and a clear understanding of its benefits, a Roth IRA can help you secure a comfortable and financially stable retirement.

Conclusion: Is a Roth IRA Right for You?

Deciding whether a Roth IRA is right for you depends on your individual financial situation, retirement goals, and tax considerations. With its tax-free growth potential, flexible withdrawal options, and lack of required minimum distributions, a Roth IRA can be a valuable addition to your retirement savings strategy.

By understanding the key features, benefits, and rules of a Roth IRA, you can make informed decisions about your retirement savings and maximize your potential for a comfortable and financially secure future. Whether you're just starting your career or nearing retirement, a Roth IRA can play an essential role in achieving your long-term financial goals.

As you continue to plan for your retirement, consider consulting with a financial advisor to ensure that a Roth IRA aligns with your overall financial strategy. With proper planning and a commitment to maximizing your retirement savings, you can enjoy a fulfilling and stress-free retirement.

You Might Also Like

Geo Security Corporation: Safeguarding The FutureWhat Time Was It 6 Hours Ago? A Comprehensive Guide To Understanding Time Calculations

All About Frias Net: Key Insights And Analysis

Top Choices For The Best Russian Brokerage Account: Maximize Your Investments

Gail Koziara Boudreaux: A Leader In Healthcare Innovation

Article Recommendations